New tools to power financial planning with business owners

Succession & Exit Planning tools

This update will include a first of its kind Succession & Exit planning tool that helps you align the client’s exit priorities, potential exit paths, and assesses their exit readiness.

Succession & Exit features include:

- A survey to surface what’s important to the client during a potential future exit

- Scores for each exit path based alignment with the client's priorities

- Exit readiness scores based on business and personal readiness action items

- A dynamic Succession & Exit deliverable based on the client's unique exit path

Wealth & Retirement Planning tools

New wealth planning insights will help you identify the liquidity potential of the business and integrate the potential proceeds into the client's financial plan and cash flow models.

Wealth features include:

- Liquidity potential analysis that shows how ownership value may turn into net proceeds after taxes and fees

- Net proceeds from exit amortization analysis that shows how net proceeds translate to annual income after exit

- Adjustable amortization variables including taxes, fees, growth rates, and inflation rates to reflect financial plan assumptions

- A stand-alone Business Wealth report

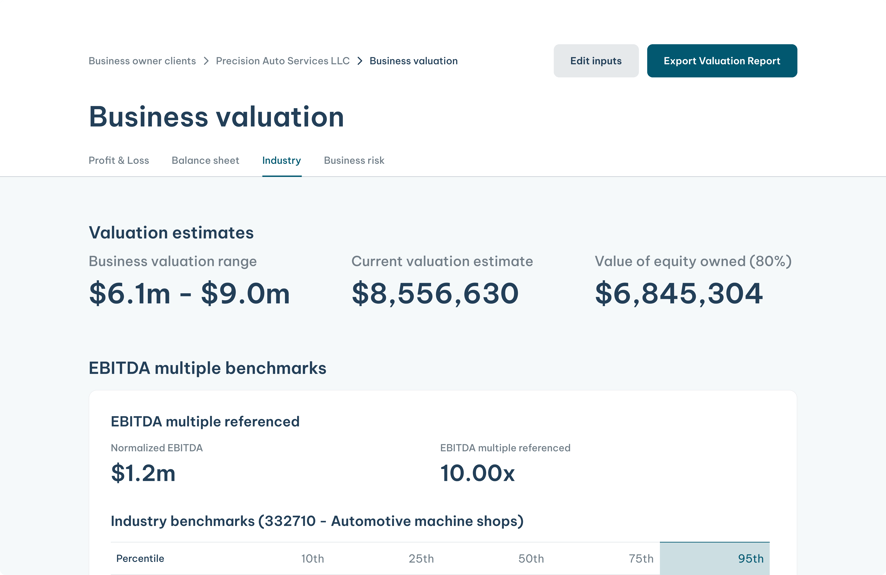

Business Valuation tools

Valuation insights will be expanded to give you and your client deeper clarity on the key factors driving valuation estimates.

Valuation features include:

- Profit & Loss analysis to show how revenue and earnings drive valuation

- Balance Sheet analysis to show the impact of assets and liabilities on valuation

- Industry multiples to show clients how they compare to benchmark companies

- Risk analysis to show how the business risk characteristics impact valuation

- A stand-alone Valuation Report

Risk Management tools

New Risk Management insights will show a breakdown of the factors driving Business Risk Score and assess buy-sell arrangement status.

Risk Management features include:

- Component risk assessment to show the key factors that influence business risk

- Risk to equity owned assessment based on the status of the owner’s buy-sell agreement and supporting funding

- A stand-alone Risk Management report

New client-ready deliverables

Flexible, white-labelled deliverables that integrate seamlessly with your services

The advice you provide business owners is more important than ever.

Thank you for trusting the RISR team!

We believe that with the right tools, you don't need to reinvent your practice or become a specialist to win with business owners.

RISR is building those tools for you.

Tools that integrate the business into the services and conversations you already know how to deliver.

Tools that place you at the center of the owner's financial planning.

Your feedback and partnership has and will continue to directly shape our vision and product.

Frequently Asked Questions

Will these updates automatically be reflected on my account?

Yes. All RISR accounts will automatically be updated to the new experience in August 2025.

Can I generate the new insights and deliverables for clients already added to RISR?

Yes! You will be asked to provide a small set of new data points to generate the new insights and deliverables for previously added clients.

What will happen to the existing insights reports I have generated?

All previously generated cases will be available for download in RISR for 3 months after the update.

If you choose to update the case data to generate new insights, the previous insights report will be replaced.

Will there be support to help me implement the new insights with my clients?

Yes. RISR will provide you with updated materials to ensure you feel confident and help you get the most out of the platform.

You can always reach out to hello@risr.com to discuss how best to integrated RISR insights and deliverables into a specific engagement with a business owner client.